August 28, 2024

Japan's GX-League and Carbon Removal in GX-ETS

A post by Tank Chen. Cover Image: DALL-E

The inclusion of CDR in Japan’s GX-ETS isn't just about increasing demand—it’s a strategic move that could define the future of the carbon removal (CDR) industry. By leveraging the GX-League, Japan is positioning itself as a leader in scaling carbon removal technologies, which could redefine market dynamics worldwide. Understanding this strategy could be key to seizing new opportunities and staying ahead in the rapidly evolving carbon removal industry.

Introduction

In 2020, Japan committed to achieving net zero greenhouse gas emissions by 2050. The Japanese government sees this net zero goal as a chance to boost industrial competitiveness and set global standards, driving economic growth and social transformation. To reach this target, the Ministry of Economy, Trade, and Industry introduced the Green Transformation (GX) strategy, aimed at shifting from fossil fuels to clean energy. A key initiative in this strategy is the GX-League, which leads this transformation effort. Central to the GX-League is the GX-ETS, an emissions trading system launched in 2023. Starting with voluntary participation, it now includes credits from methods like direct air capture and bio-energy with carbon capture and storage. Japan's strategy not only aims to meet net-zero goals but also to create new commercial opportunities. The development of the GX-League and the GX-ETS provides insight into the workings of the GX strategy and its implications for carbon removal (CDR) market participants.

GX-League

The Green Transformation League, or GX-League, is a Japanese forum where companies, universities, academic institutions, and the government collaborate to meet greenhouse gas reduction targets and boost industrial competitiveness by focusing on Japan's 2050 carbon net zero goal, driving economic growth and transforming Japan's economic and social systems.

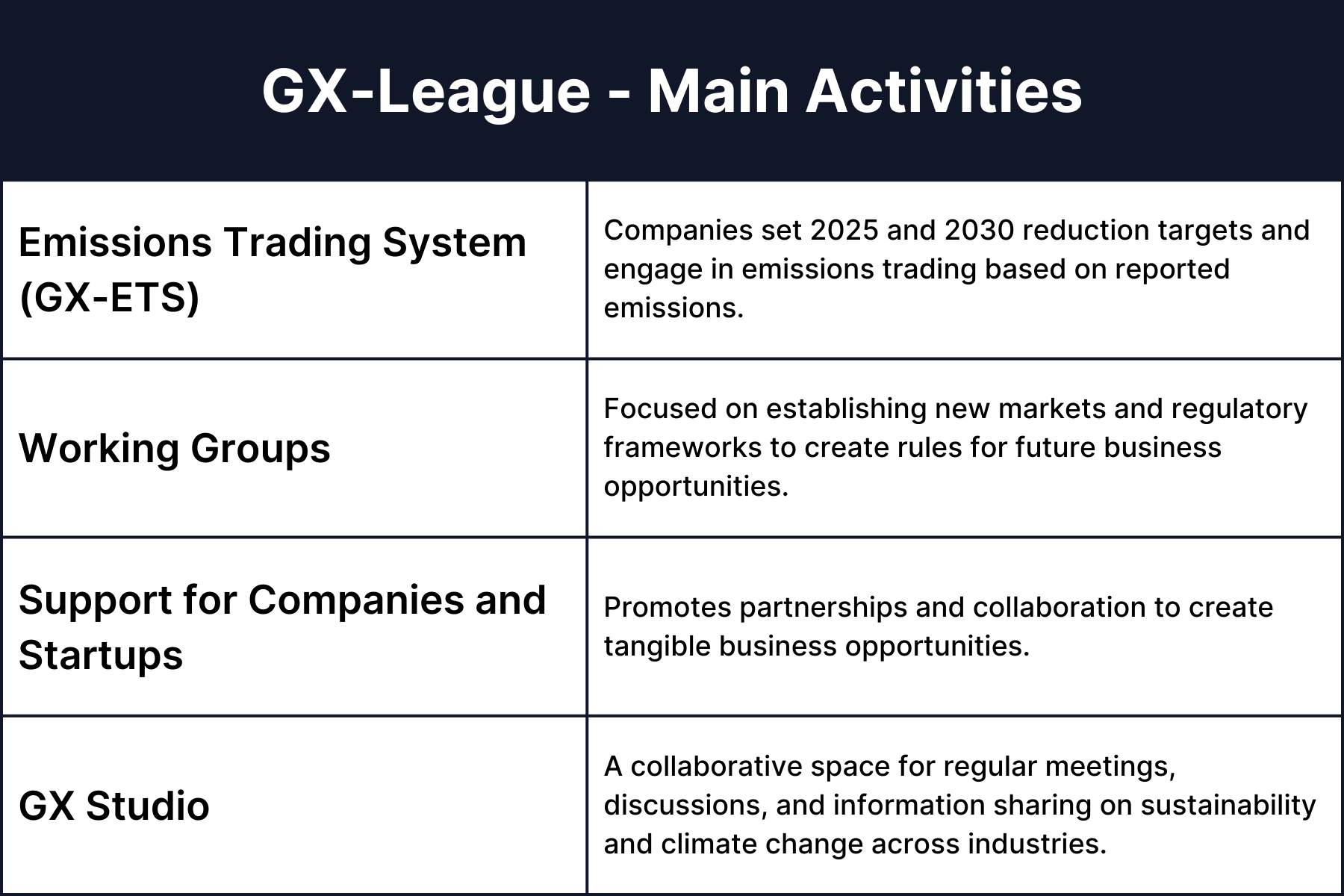

The GX-League supports four main activities for participating companies:

GX-ETS

Launched in April 2023, GX-ETS is Japan’s emissions trading system that targets regulatory, financial, and technological priorities for green industries, encouraging companies to lead in the transition to carbon neutrality and excel in international business through a ten-year plan:

- Phase I: A voluntary baseline-and-crediting system from 2023 to March 2026.

- Phase II: Transition to a conventional ETS in 2026.

- Phase III: Focus on accelerating decarbonization in the energy sector through auctions by 2033.

In Phase I of the GX-ETS, participating companies must set detailed direct and indirect emissions reduction targets for both 2025 and 2030. These targets are based on an emission baseline from the base year 2013 or the average emissions of any three consecutive years between 2014-2021. If companies fail to meet their reduction targets, they must (1) purchase reduction quotas from others, (2) buy eligible carbon credits, or (3) explain the reasons for not meeting the targets.

Excess reduction quotas are granted to companies whose actual reductions exceed the NDC targets of 27% in 2023, 29.7% in 2024, and 32.4% in 2025. Previously, eligible carbon credits were limited to Japan's Greenhouse Gas emission reduction/removal certification schemes: J-Credits (from projects within Japan) and Joint Credit Mechanism (JCM) credits (from projects in one of the 29 countries with whom Japan has bilateral agreements). A recent announcement has added carbon removal credits to the list of eligible credits. GX League companies can use these eligible carbon removal credits for up to 5% of their total greenhouse gas emissions calculation.

Carbon Removal in GX-ETS

The GX-ETS will now accept credits from three carbon removal methods: direct air carbon capture and storage (DACCS), bio-energy carbon capture and storage (BECCS), and coastal blue carbon, (in addition to carbon capture and utilization (CCU) projects). Other methods being considered for future integration include enhanced weathering, ocean alkalinity enhancement, ocean iron fertilization, and macroalgae cultivation. These additional methods are not currently included given that most are in early technology-development stages. [Biochar carbon removal is currently covered by the domestic J-Credit scheme under the Biochar addition to mineral soil in cropland/grassland methodology.]

For carbon removals to be eligible for the ETS, projects must meet criteria ensuring credit quality. These include effective governance, additionality, permanence, robust monitoring, reporting, and verification processes, sustainable development, safeguards against double issuance, crediting, and claiming, and independent third-party validation and verification. Projects and methodologies aligned with international standards, such as the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) Emissions Units by the International Civil Aviation Organization (ICAO) and the Core carbon Principles (CCP) Label by the Integrity Council for the Voluntary Carbon Market (ICVCM), are considered to meet these quality standards. Leading carbon removal registries, namely Puro and Isometric, are both in pursuit of having their standards assessed by the ICVCM and also by the ICAO.

While there are no restrictions for projects set to be deployed in Japan, overseas projects must be those that are technically challenging to implement under the JCM or in partner countries. Additionally, while there are no limitations for companies using credits from domestic projects, companies wishing to use credits from overseas projects must meet four criteria.

Criteria for CDR Projects Outside Japan

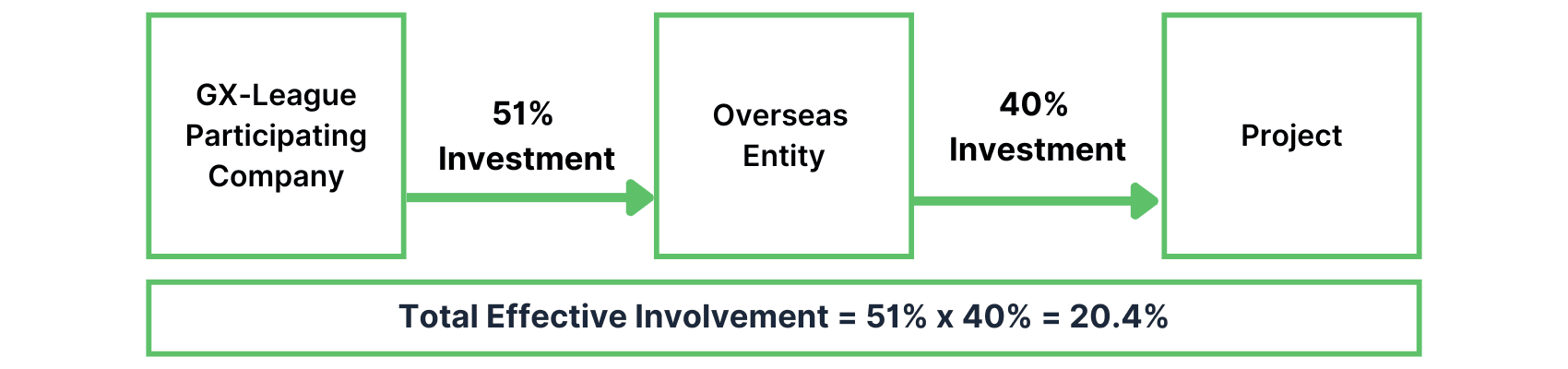

First, any GX-League company wishing to use credits from overseas projects must be a company, a subsidiary, or a subsidiary of an entity where multiple league companies hold a combined 51% investment. The company must have invested in the project since the early stage, defined as before the issuance of the first credit, except for investments with specific goals such as technology transfer. Companies that withdraw from a project midway are not eligible. The company must have invested at least 20% in the project or be a technology or solution provider, including measurement, reporting, and verification (MRV) and operations and maintenance (O&M), contributing to the project. Even if a company invests indirectly through an overseas entity, it must effectively invest 20% or more in the project. For example, if a GX League participant invests 51% in an overseas entity that invests 40% in the project, the participant’s effective involvement is 51% x 40% ≈ 20%.

In summary, GX League companies or their subsidiaries must have been continuously involved in projects by effectively investing over 20% since before the first credit issuance to use credits from overseas projects.

Specific Limitations for Carbon Capture Projects

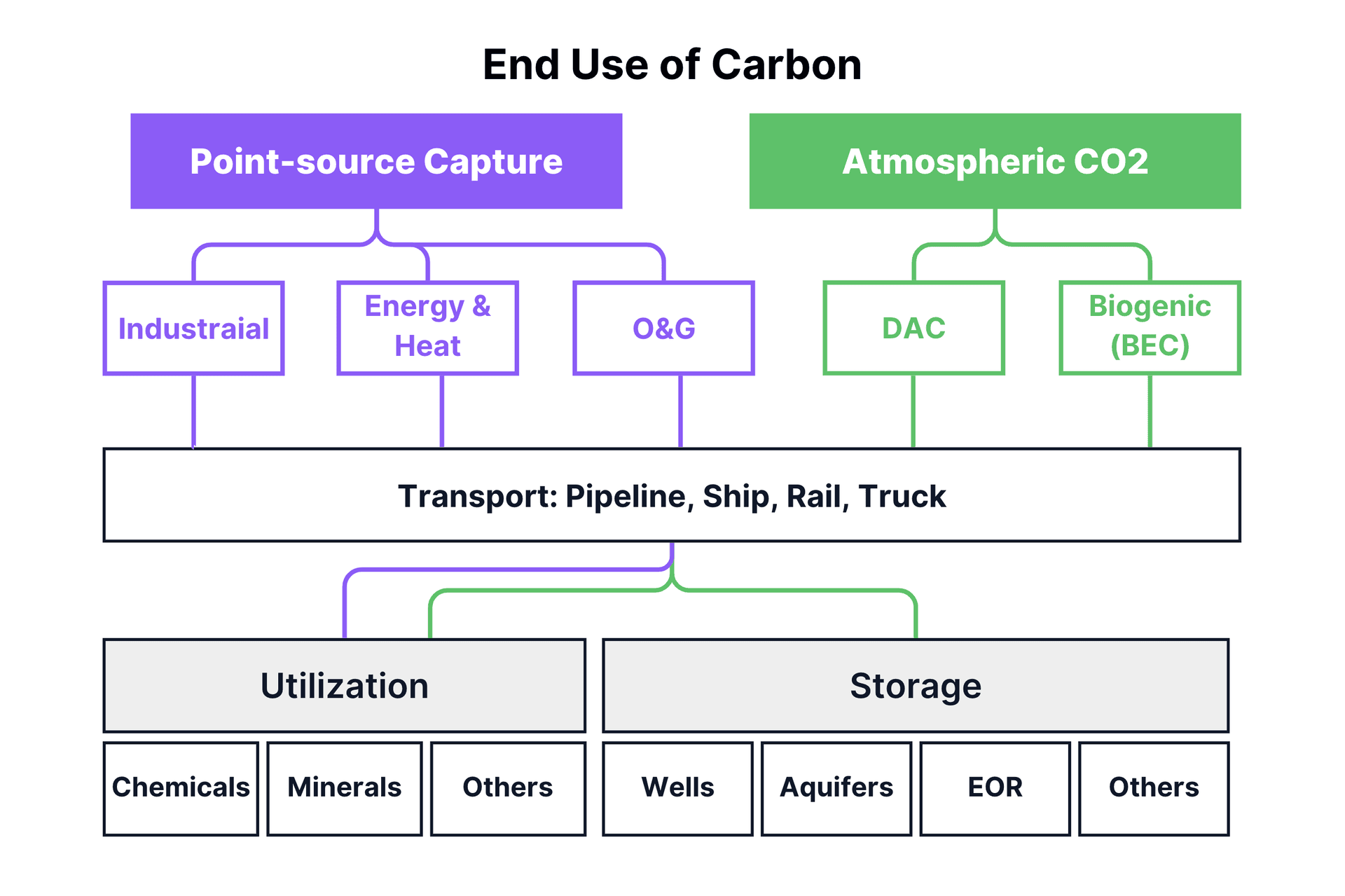

One specific limitation for carbon capture projects is the storage and end use of the captured carbon. Eligible projects include atmospheric direct air capture and point-source capture from bio-energy production, energy and heat production, industrial processing, and oil and gas operations. For credits to be eligible, carbon captured from energy and heat production, industrial processes, and oil and gas operations must be used in chemicals, minerals, or other products, but not stored. However, for direct air capture and bioenergy with carbon capture projects, captured carbon can be (1) utilized in products or, (2) stored in depleted oil and gas fields, aquifers or (3) used for enhanced oil recovery (EOR), or (4) other storage methods. Carbon dioxide (CO2) from all carbon capture projects can be transported via pipelines, ships, rail, and trucks.

Motivation for the Inclusion

There is an expectation that the three types of carbon removal methods (and CCU) will be included in Japan’s future Nationally Determined Contribution (NDC) inventory. In the same month as the announcement of the inclusion of CCU and coastal blue carbon, the Japanese government submitted the national emissions inventory to the United Nations Framework Convention on Climate Change (UNFCCC), including these methods.

Japan has the world’s 6th longest coastline, with blue carbon accounting for -0.03% of national emissions. Coastal blue carbon programs are domestic projects that directly contribute to the nation’s NDC. This is facilitated by an existing carbon crediting system called J Blue Credits, developed by the Japan Blue Economy Association and endorsed by the government.

Japan and Japanese corporations, many of whom are GX League members, have invested extensively in carbon capture and storage (CCS) and CCU projects. Japan aims to increase its annual storage volume to 6-12 million tonnes by 2030 and is developing CCS projects for storage on land and in marine aquifers, both domestically and internationally, primarily in Malaysia. Japan is also focused on growing the carbon utilization industry for products like polycarbonates, synthetic fuels, construction materials, and hydrogen. While DACCS and BECCS projects overseas do not contribute to Japan’s national inventory, they offer Japanese companies opportunities to participate in a nascent and essential industry and gain competitive advantages early.

One of the additional requirements for overseas projects is that “participating companies must contribute their technology towards creating a virtuous cycle between the environment and the economy”. Given that one of the goals of the GX-ETS is to enhance the future competitiveness of Japanese companies and acquire new markets early, Japanese companies, especially global industrial actors, are encouraged to take advantage of financial and regulatory incentives provided by governments in the US and EU CDR markets. The hope is that involvement in overseas projects will allow them to develop technologies or acquire operational capabilities that can later become new commercial opportunities, benefiting both the environment and the economy.

Investing in Future Opportunities

Japan understands that to reach Net Zero by 2050, it will need to neutralize its 50 to 240 million tons of estimated residual emissions with CDR. The 747 companies in the GX-League represent over 50% of Japan’s emissions, or over 570 million tons. Allowing the use of carbon removal in the GX-ETS for up to 5% of these emissions could unlock a 28 million tons per year market for carbon removal. Although the cost of carbon removal remains an issue, encouraging collaboration between GX-League companies, such as forming joint demand groups, may help address this challenge. Japanese companies are already actively involved in the industry as buyers, technology developers, project developers, and financiers, and it is likely they will continue to invest in carbon removal projects directly or indirectly.

The inclusion of CDR in the GX-ETS sends a strong signal from the Japanese government in support of developing carbon removal worldwide. It indicates the country’s intention to leverage the “Green Transformation” league to help drive down costs, increase the demand for CDR, and build up the technical capabilities of Japanese companies for a future industry. This is poised to be a significant lever for driving demand, potentially opening up a new market of buyers for CDR suppliers. However, the unique aspect of the GX-League for CDR lies in the diverse roles that participating companies can play. These companies are not just potential buyers of carbon removal credits; they also serve as funders, supply chain partners, clients, collaborators, and even competitors. This multifaceted involvement could accelerate innovation and foster collaborations within the carbon removal sector, leading to more rapid advancements.

Explore

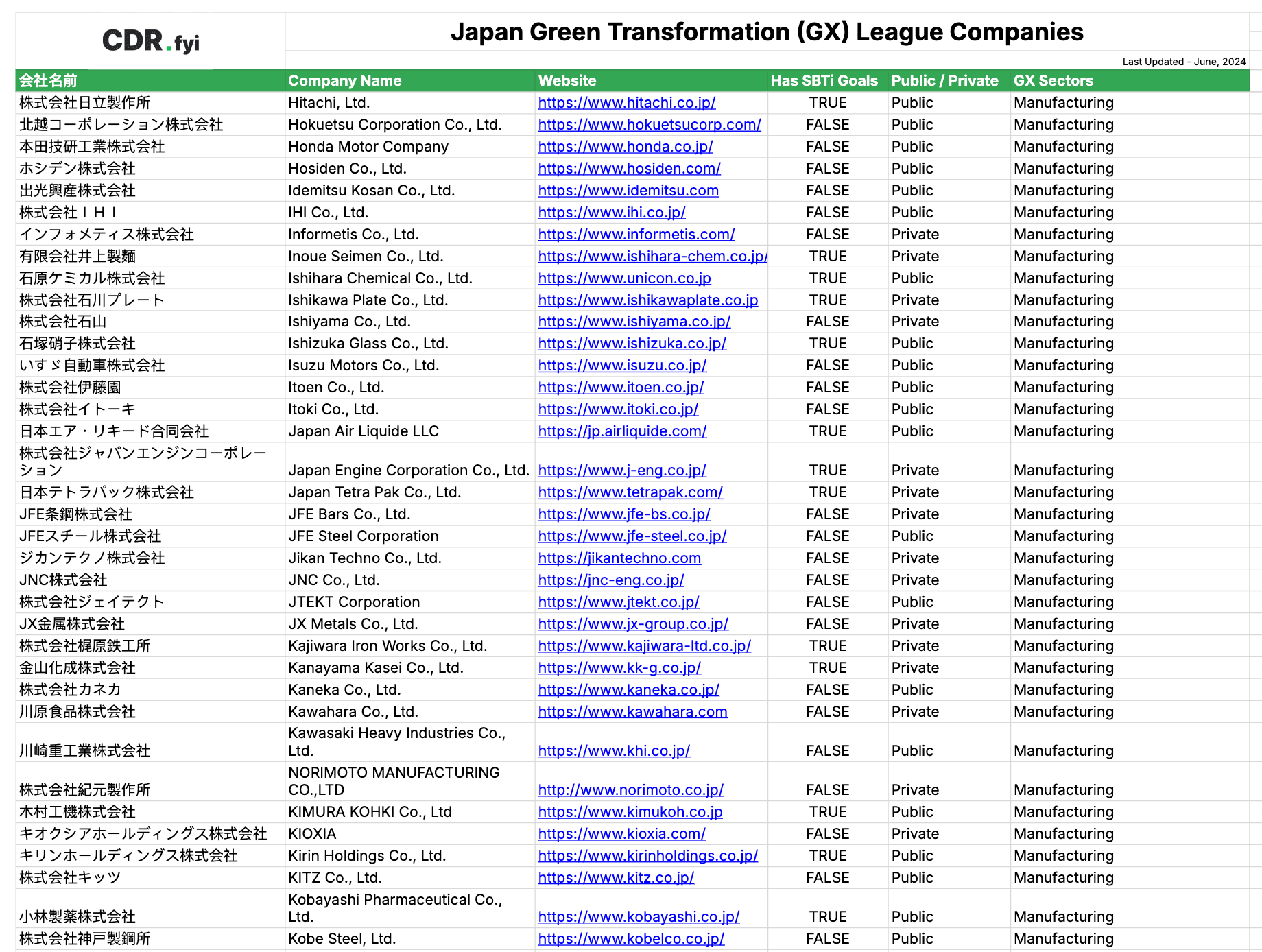

Explore our database of GX-League companies - HERE.

This post was written by Tank Chen. The GX-League Company Database was curated by Anna Pasini. In our next post, we will explore the different roles Japanese companies in different sectors can play in the global carbon removal industry. Stay Tuned.

🈺 For GX-League companies, you can learn more about the durable carbon removal market by exploring CDR.fyi’s Carbon Removal Map and the Carbon Removal Calculator, becoming a CDR.fyi Portal Partner, or reach out to us at team@cdr.fyi.

✅ For Suppliers, join over 400 companies and sign up as a CDR.fyi Data Partner to gain durable CDR market insights, showcase your company’s profile and progress, and list your HQ and project and facility locations on the map.