September 30, 2024

CDR Monthly Recap - September 2024

We are back with another edition of the CDR Monthly Recap, a monthly round-up of some of the top news, developments, and market updates from the world of durable carbon removal.

After a slow August, September saw a huge surge with sales of over 600,000 tonnes of CDR, with a number of big deals which saw the likes of Microsoft, Google, Frontier, Holocene and CarbonRun lead the line. Other developments such as large funding rounds, new projects, and partnerships continue to drive momentum for the industry ahead, along with a host of events in the field.

Read on to learn more below!

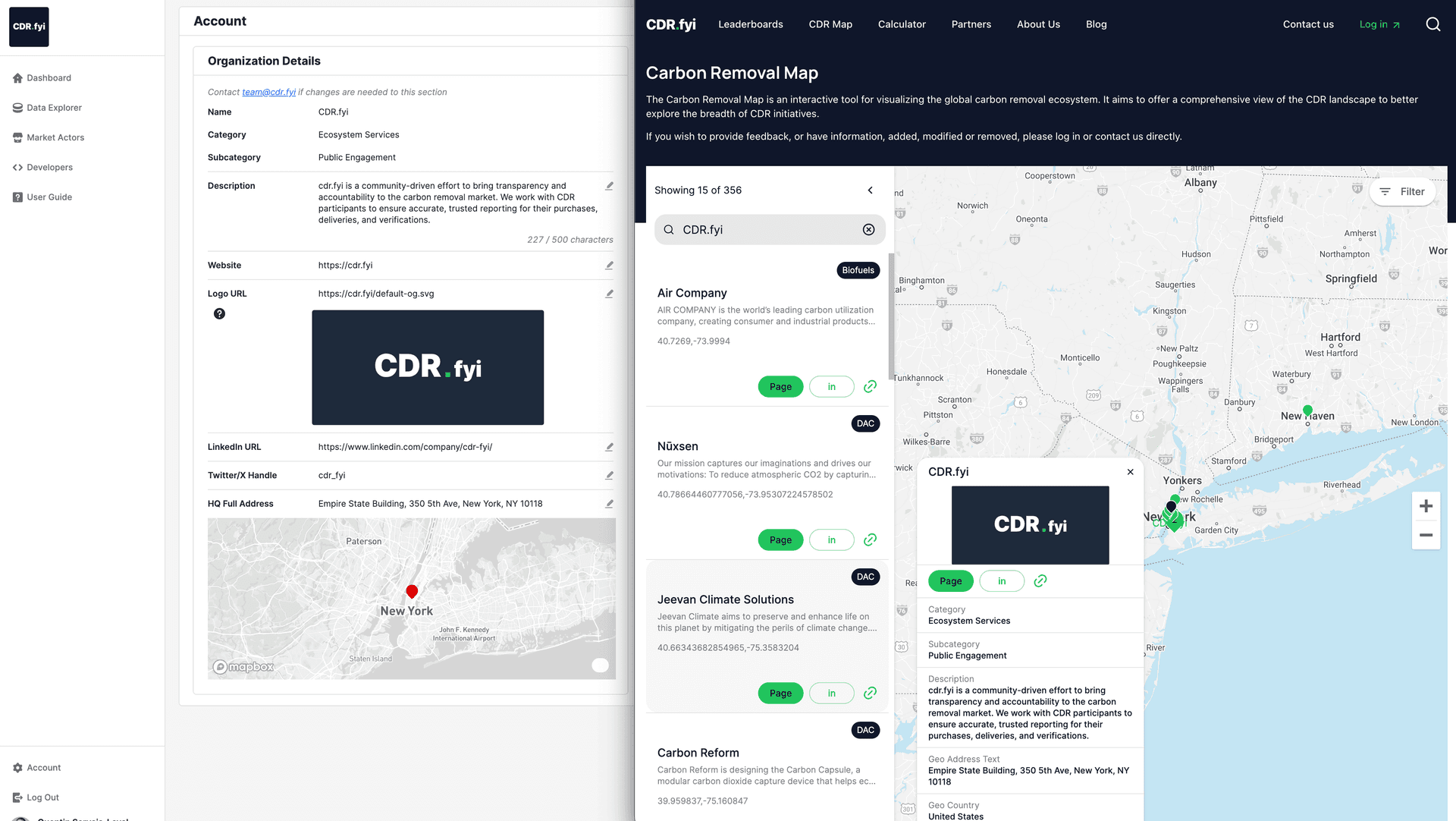

Want to know more about durable CDR? Join over 500 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!

Deals and Partnerships

[Image source: Ørsted]

Ørsted entered into an agreement to sell 330,000 tonnes of CDR credits to Equinor over the next 10 years. The tonnes will be delivered from Ørsted’s Kalundborg CO₂ Hub, which will capture 430,000 tonnes of biogenic CO₂ starting 2026.

Google and direct air capture (DAC) startup Holocene signed an offtake agreement worth $10 million for a sale of 100,000 tonnes of CDR. At $100/tonne, (with support from the US 45Q subsidy of $180/tonne) this is the lowest known price per tonne in a DAC deal to date.

Frontier signed a $25.4 million offtake agreement with CarbonRun to buy 55,442 tonnes of CDR, a first for Frontier via the River Alkalinity Enhancement method. The tonnes will be removed between 2025 and 2029, starting with CarbonRun’s site in Nova Scotia, Canada.

Microsoft announced three new deals to purchase 34,400 tonnes of CDR from Enhanced Weathering companies - UNDO (15,000 tonnes), Lithos Carbon (11,400 tonnes) and Eion (8,000 tonnes).In a deal worth $11 million, which was facilitated by CUR8, British Airways purchased 30,000 tonnes of durable CDR from 6 suppliers. It has also become the largest purchaser of CDR in the UK.

Microsoft and carbon-negative energy company Arbor announced a new agreement for the delivery of 25,000 tonnes of CDR. The tonnes will be delivered by Arbor from 2027 over a period of 5 years, at 5000 tonnes a year.

Frontier announced prepurchases of CDR worth $4.5 million from 9 companies - Alithic, Alt Carbon, Anvil, Capture6, Exterra, Flux, NULIFE, Planeteers, and Silica, on behalf of its buyers via Watershed.

Drax Group launched its US-based BECCS subsidiary, Elimini, in New York Climate Week. The newly formed company has also entered into 11 carbon dioxide removal agreements with eight companies.

Standard Chartered and SEB partnered with Puro.earth to offer offtake agreements from Puro Standard-certified CDR projects to their clients, with Puro ensuring highest standards in carbon accounting and permanence.

DAC company Climeworks announced a new partnership with non-profit climate fund Terraset to enable an impact-driven way to support Climeworks and unlock philanthropic capital to accelerate and deploy its carbon removal solutions.

CDR marketplace Supercritical and biochar producer Exomad Green entered into a partnership to offer buyers exclusive access to 100% of Exomad Green’s remaining 2024 biochar credits, which represents 50% of the total remaining biochar market supply for 2024.

RMI, Third Derivative, and Deep Science Ventures, with Builders Vision, launched Mark1, a new project developer, to accelerate commercialization of emerging climate tech including carbon removal solutions.

Standard Chartered, British Airways, CUR8, CFC, and WTW partnered to complete a first-of-its-kind debt financing deal for UK-based enhanced weathering (EW) developer UNDO.

Kenya-based project developer Great Carbon Valley and French DAC company Yama entered into a partnership to integrate DAC and energy technologies to establish sustainable carbon removal and green industrial hubs in key locations across the Great Rift Valley.

Dutch DAC company Skytree announced a strategic partnership with Finnish manufacturing firm Scanfil to advance its manufacturing scale. Skytree’s Cumulus and Stratus units will have Scanfil as its manufacturer.

Climeworks announced that it has signed a new agreement with British Airways to remove CO₂ emissions from the air on behalf of the airline, using its technology.

EW company Flux partnered with the Nigerian federal government to boost crop yields, improve farmer climate resilience, and generate high-quality CDRs, aligning with Nigeria's Paris Agreement commitments.

Montana Technologies, the developer of AirJoule® atmospheric water generation technology, signed an MoU with DAC company Clairity Technology to deploy AirJoule® units to support Clairity’s DAC operations.

Ocean CDR startup Banyu Carbon announced a new partnership with James Robinson Speciality Ingredients (JRSI), to co-develop innovative reversible photoacids, to advance Banyu’s process of capturing CO₂ from seawater.

Interholco, which specializes in international timber trade announced that its carbon credits are now endorsed by the International Carbon Reduction and Offset Alliance (ICROA), listed on the Carbon Standard (CSI) registry.

Projects

[Image source: 1PointFive]

1PointFive’s Stratos facility received draft Class VI permits from the US Environmental Protection Agency (EPA) to inject CO₂ more than 4,000 feet underground in the heart of the energy-rich Permian Basin, Texas. The wells are tied to the Stratos Facility, which aims to remove 500,000 tonnes of CO₂ a year.

Total Energies, Equinor, and Shell announced the completion of CO₂ receiving and storage facilities for the Northern Lights Joint Venture in Norway, the world’s first commercial CO₂ transport and storage project, with an initial capacity of 1.5 megatonne CO₂/year.

Shopify launched Carbon Commerce, a platform for the online sale and purchase of carbon credits. Initial sellers of credits on the platform include Heirloom, Graphyte, and Grassroots Carbon. It also provides registry integration with Isometric.

UK-based climate tech firm A Healthier Earth announced plans to build the UK’s largest biochar facility in Royal Wootton Bassett, Wiltshire, partnering with PYREG. Set to produce 9,000 tonnes of biochar annually, the project will capture and store 17,000 tonnes of CO2 starting in 2025.

Italian startup Limenet, which specializes in ocean alkalinity enhancement (OAE) launched its first industrial plant in Augusta, Italy, capable of removing 800 tonnes of CO₂ annually.

Limestone-based CDR provider Origen announced an agreement with Shell and Mitsubishi to collaborate on engineering studies for a project at the Pelican DAC Hub in southern Louisiana. The project is expected to remove up to 50,000 tonnes of carbon per year.

In an announcement by the company’s co-founder Alexsandra Guerra, it was confirmed that carbon marketplace Nori had officially ceased operations. The reason cited by CEO Matt Trudeau for the company’s closure was ‘the challenges of a stagnant Voluntary Carbon Market (VCM) and tough funding environment.

Biochar production equipment manufacturer PYREG launched new support services designed to assist biochar project developers. It has also partnered with Carbonfuture and Mangrove Systems for dMRV tools.

Carbon credit developer Midori Climate Partner launched a new biochar project in partnership with CSNC Agriculture, a cashew nut processing factory in Kampong Thom, Cambodia. The project aims to generate 10,000 CDR credits a year.

Financing

[Image source: US DOE]

The U.S. Department of Energy’s Office of Clean Energy Demonstrations (OCED) announced plans to fund up to $1.8 billion to support the development of mid- and large-scale DAC facilities, advancing DAC technologies and expanding Regional DAC Hubs.

1PointFive announced that the U.S. Department of Energy’s Office of Clean Energy Demonstrations (OCED) will provide up to $500 million to support the development of the South Texas DAC Hub. An initial award of $50 million will advance the ongoing work at the site.

CDR marketplace Carbonfuture completed an oversubscribed Series A round, led by SIX, to scale its digital Monitoring, Reporting, and Verification (dMRV) solution to bring trust and efficiency in the CDR market.

Dutch DAC startup Carbyon secured an investment round of $16.9 million. The round saw participation from Siemens Financial Services, Omnes Capital, Global Cleantech Capital, Invest-NL, Innovation Industries, Lowercarbon Capital, and the Brabant Development Agency (BOM).

Munich-based DAC company Phlair raised €14.5 million in seed funding, which was led by Extantia, with participation from Planet A Ventures and Verve Ventures.

German DAC company Ucaneo closed a seed funding round for $7.45 million. The investment round was co-led by Energie 360° and IBB Ventures and also saw participation from Plug and Play Sustainability Fund and Grantham Environmental Trust.

Leading decarbonization technology and project developer 8 Rivers Capital secured an investment from JX Nippon Oil Exploration to support the deployment of its Calcite DAC solution, advancing it from pilot to commercial development.

The Wilkes Center for Climate Science & Policy awarded biochar technology company Applied Carbon the $500,000 Wilkes Climate Launch Prize for its mobile solution that converts crop waste into carbon-rich biochar in the field.

Amsterdam-based startup Brineworks raised $2.2 million (€2 million) in a funding round led by Pale Blue Dot to advance its innovative Direct Ocean Capture (DOC) technology.

Montreal-based CDR project developer Deep Sky secured a fresh investment of $2.5 million CAD from financial institutions National Bank of Canada and BMO, demonstrating their support of Deep Sky's development of carbon removal infrastructure.

CarbonX Climate announced the closing of a new oversubscribed investment round, which saw participation from Redstone, Engie New Ventures, and PROfounders. The new investment will help CarbonX expand into new geographies and build science-based tools to professionalize and accelerate the CDR industry.

Kairos Carbon, a US-based startup that removes CO₂ from biomass, closed its pre-seed funding round with Zero Carbon Capital. The investment will help Kairos implement its CDR technology and value recovery.

Metalplant, which uses enhanced weathering to mine nickel while removing CO₂, announced that it had received $1.72million from ARPA-E's PHYTOMINES program, which funds research into phytomining and development of low-carbon nickel.

Airminers announced the selection of 20 CDR startups as part of its Kiloton Fund. Shopify is offering each selected team a $100,000 purchase to further validate their potential and fast-track commercialization.

Sweden-based environmental impact platform Milkywire announced that it is expanding its offering with 2 curated CDR portfolios across 27 suppliers from which companies can purchase CDR credits.

Australian enhanced weathering startup Carbonaught received a fresh investment from Singaporean VC firm Better Bite Ventures. Currently, Carbonaught is testing its technology in the U.S. and Australia across a number of farms.

Airminers announced the launch of Airminers Buyer’s Academy - a new program aimed at helping sustainability professionals understand the carbon removal market and make informed purchasing decisions through a series of virtual workshops, starting October 3, 2024.

Policy and Research

[Image source: Puro.earth]

CDR registry Puro.earth announced that its platform is now available for Frontier suppliers looking to certify their projects, pending Frontier's approval of relevant methodologies. Certified removals will be issued as CO₂ Removal Certificates (CORCs) in the Puro Registry.

Carbon to Sea Initiative and COVE selected 4 research projects for its 2024 Joint Learning Opportunity, supporting ocean-based CDR technologies, with partners Planetary Technologies and Dalhousie University.

Mangrove Systems partnered with Pacific Biochar to launch the first biochar project using the Climate Action Reserve’s new U.S. and Canada Biochar Protocol, leveraging Mangrove’s MRV solution.

Reports

[Image source: CDRjobs.earth]

CDRjobs released its first annual “2024 CDR Salary Report”, sharing key insights such as top geographies, disciplines, and median figures, amongst others, in relation to salaries in CDR. CDRjobs also launched its own Job Board with 745 opening roles, along with details of its partnership program.

Nasdaq released a new report on the CDR market, sharing insights into how the market for durable CDR credits has changed over the past year and the role carbon credits play in net zero strategies.

Carbon rating agency BeZero Carbon released a new report sharing learnings from a year of rating CDR projects. Some of the highlights include - the need for durable CDR, cost barrier, rating impact, and emerging technologies.

Isometric released a whitepaper highlighting 9 key principles for rigorous monitoring, reporting and verification (MRV) that have emerged from discourse between the industry’s leading buyers, suppliers and scientists.

The Carbon Business Development Council, in collaboration with the Carbon Business Council, released a new report which emphasizes on the significant benefits that CDR can provide to utilities.

The Carbon Business Council also released the "Demand-Side Support for Scaling Carbon Dioxide Removal Policy Primer," highlighting the need for policy measures to boost demand for CDR solutions.

Rocky Mountain Institute (RMI) released a new report “Breaking Barriers in Carbon Dioxide Removal with Electrochemistry” which examines electrochemistry-based CDR, its benefits, trade-offs, and offers guidance on evaluating innovations.

Planetary released its 2023 Impact Report, highlighting progress in advancing Ocean Alkalinity Enhancement (OAE) and detailing its 2023 projects, research, and partnerships.

Leaderboard Updates

After a slow August which only saw around 4000 tonnes of reported purchases, September has seen a massive surge with over 600,000 tonnes of CDR sold.

Listed below are the September leaderboards for top suppliers and purchasers:

Supplier Leaderboard

Purchaser Leaderboard

Events round-up - September 2024

[Image source: Sylvera]

Sylvera hosted a webinar on investment trends in CDR which featured leaders in the industry including CDR.fyi Co-founder and CEO Alexander Rink, Stacy Kauk, Head of Science at Isometric, and Oliver Lejeune, Carbon Data Analyst, QC Intel.

Carbonfuture hosted a webinar discussing the essential role of independent, digital MRV and how it builds confidence in the integrity of the carbon removal market, which featured a panel of leaders from Swiss Re, Puro.earth, Exomad Green, and Octavia Carbon.

Ocean Visions and Hourglass Climate co-hosted a webinar titled “Advancing a Transparent and Responsible mCDR Industry” - highlighting the applied research in the service of a transparent marine CDR industry.

This year’s Climate Week New York brought together industry pioneers, experts, and stakeholders in the carbon removal ecosystem, which included various summits and events by organizations such as Puro.earth, Isometric, Ocean Visions, Flowcarbon, Climeworks, Gentoo.earth, Grain Ecosystem, and USBI, amongst others.

Check out the CDR Events Calendar to stay updated with upcoming CDR events in October and beyond.

CDR.fyi Updates and Research

- Accelerating Carbon Removal for 2050 and Beyond

Our biggest update in September centered around CDR.fyi’s official recognition as a Public Benefit Corporation (PBC) and our Co-founder Alexander Rink’s assumes the role of CEO. We also shared updates on the development of a suite of data products and content to help accelerate the growth of carbon removal, such as the CDR.fyi Portal, CDR.fyi API along with expanded durable carbon removal market analysis and insights.

- The Google - Holocene Deal: Pricing the Future

In this article on the Google-Holocene deal for 100,000 tonnes of CDR, we discussed its different aspects such as - the pricing strategy behind the deal, the benefits to both companies, and its overall impact on the durable carbon removal market.

We also hosted a Twitter Spaces session on September 12 with Anca Timofte (Holocene), Jack Andreasen (Breakthrough Energy), and Jason Hochman (Direct Air Capture Coalition) discussing the deal in detail. Check out the recording here to learn more.

Stay connected

Follow us on LinkedIn for This Week in CDR and CDR Soundbytes.

We'd love to hear from you! Reach out to us anytime with suggestions or comments at team@cdr.fyi.

Join over 500 companies and sign up for free access to the CDR.fyi Portal to gain market insights, showcase your company’s profile and progress, and get on the CDR Map!